Everything You Need to Know About Declaration of Trust & Property

Envisioning the UK Under Labour Leadership: What to Expect

Kendall Jenner and Hailey Bieber Share Laughs During an Unexpected Traffic ...

Wall Street Rollercoaster: From Sky-High Upgrades to the Downgrade Dilemma

Unleashing the Human Resistance: Matthew Butterick's Battle Against AI Gian...

-

Unleashing the Human Resistance: Matthew Butterick’s Battle Against AI Giants

In the bustling cityscape of San Francisco, a legal maverick, Matthew Butterick, strides confidently towards a legal showdown against AI giants...

Legal AdviceHelen HaywardJanuary 10, 2024 -

Why Mortgage Rates May Drop in Future But it Won’t Make Houses Cheaper in Canada

As we approach the end of the year, the Canadian real estate market is abuzz with a mix of cautious optimism...

Finance & BusinessSven KramerJanuary 1, 2024 -

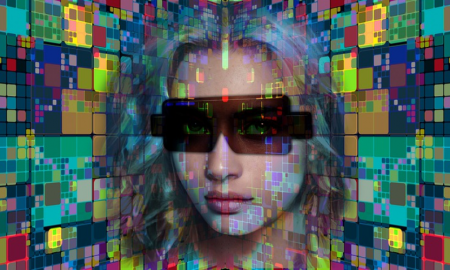

Why People Are Investing Millions in the Metaverse

In the digital world of the metaverses, people are shelling out jaw-dropping amounts for virtual properties. Imagine paying millions for a...

Pocket ChangeHelen HaywardDecember 27, 2023 -

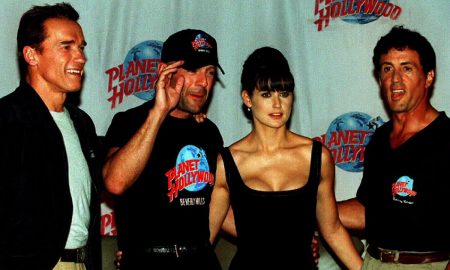

Hollywood Investment: Celebrities Link Up With PLUS Capital

The journey from film sets to the financial fray is not a path tread by many, but it is one that...

Star AdvisorSven KramerDecember 12, 2023 -

Why Mortgage Rates Are Constantly Going Up in the U.S.

The ever-shifting landscape of mortgage rates in the United States is a topic that merits attention, especially for those looking to...

Pocket ChangeSven KramerDecember 7, 2023 -

Celebrity Business Ventures That Failed

We all love our favorite celebrities and when it comes to businesses, their names and views can easily sway the masses into...

Star AdvisorSven KramerDecember 3, 2023 -

Why You Need to Think Twice Before Buying a House

So, you have been scrolling through real estate listings, envisioning your dream kitchen, and even bookmarking paint colors for the nursery....

Legal AdviceSven KramerNovember 26, 2023 -

Santo Spirits: Sammy Hagar and Guy Fieri’s Joint Venture

In the world of business partnerships, some combinations might seem unconventional at first glance. But when you delve deeper into the...

Star AdvisorSven KramerNovember 16, 2023 -

Everything You Need to Know About Mortgage Rate Lock

You have probably embarked on the exciting yet nerve-wracking voyage of purchasing a home. Amidst the sea of paperwork, open houses,...

Pocket ChangeSven KramerNovember 9, 2023 -

7 Effective Ways to Make Your Business More Sustainable

In an age of rising environmental consciousness, making your business more sustainable isn’t just a trend; it’s a necessity. Sustainable practices...

Finance & BusinessJames WileyNovember 3, 2023