An Early Retirement? Here’s How to Invest If You Prematurely Stop Working

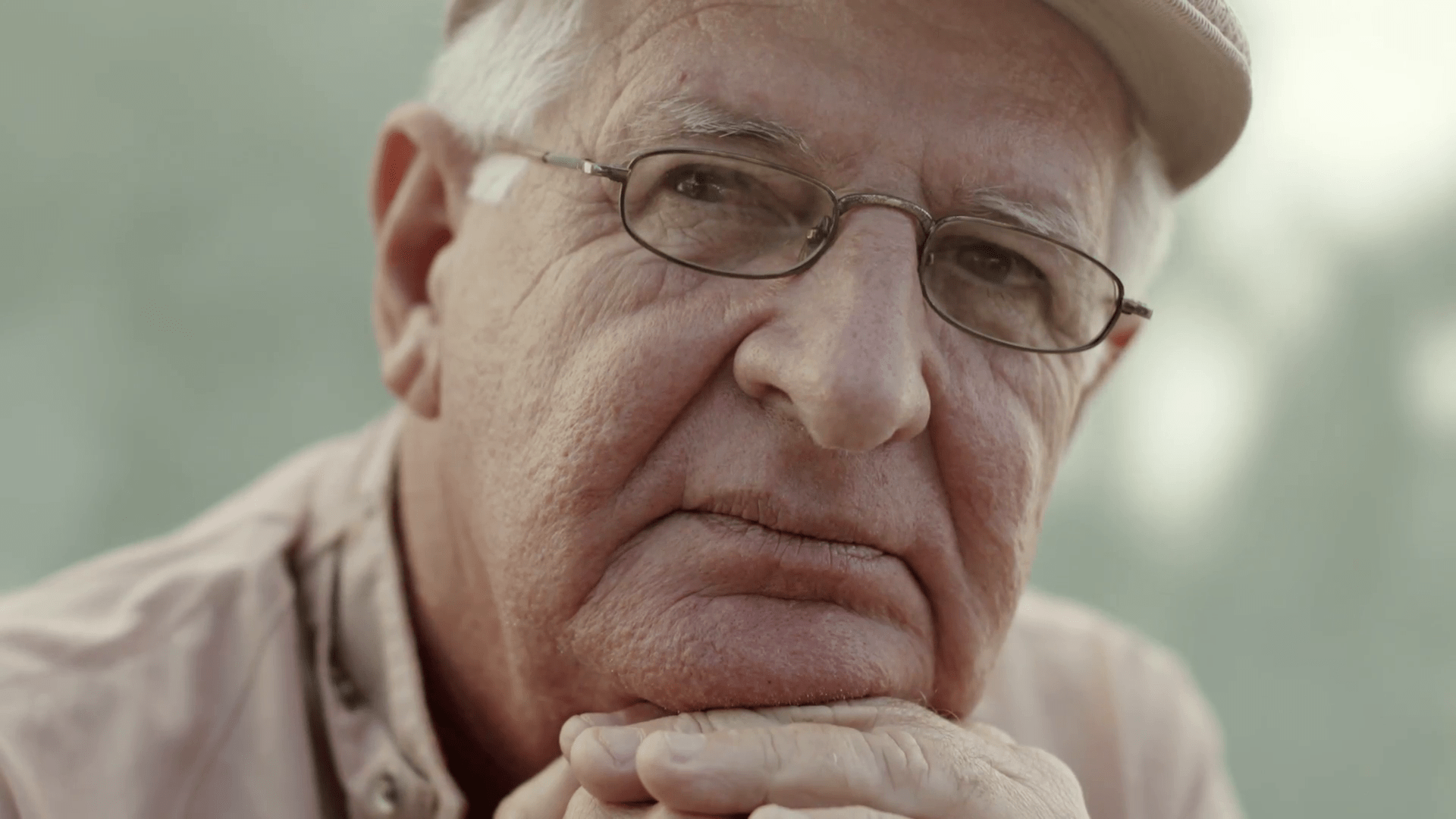

Picture this, you’ve been working hard for years and are now starting to feel super confident with how your financial future will pan out. Suddenly, an unprecedented occurrence in your life forces you to retire 10 years earlier than you had anticipated.

Perhaps it was a result of a serious medical issue. Or maybe you got fired from your job in your early 50s and it’s been tough to find another. Indeed, the aforementioned unpredictability, as well as other unfortunate events, are not uncommon.

As a matter of fact, the Voya Retire Ready Index estimates that 60% of current retirees had not planned to retire at the time that they had. Nevertheless, because retirement can be an unexpected occurrence is not an excuse for it not to be planned.

That being said, here are some of the things that you can do to prepare for the event that your retirement happens earlier than you had expected.

Despite early retirements being unplanned for, they happen to many Americans today

Having an Early Retirement as a Result of Health Complications

About 91% of Americans have issued their concern about their inability to afford healthcare during their retirement years as per the Voya Retire Ready Index.

With such stats, it is vital that one starts planning to cover any health expenses prior to retiring so that these issues do not catch up with you in the future.

One of the smartest ways is to start developing a savings plan for the current working years that you will be in service, choosing to focus on your monthly retirement income rather than focusing on your total savings figure that you will have.

Being able to predict your monthly income will help you determine if you have been saving enough to cover your retirement, your healthcare, as well as your living expenses.

For this to work, you need to consider requesting professional help from the services of a financial adviser, or opt for a retirement planning tool.

Any of this can help you determine the amount of money that you will need to have to ensure that you will have a comfortable month during your retirement.

Additionally, you can direct contributions to an emergency fund into your monthly budget as well, so that you can have the flexibility to manage your expenses if you die unexpectedly as a result of health complications.

If not planned for early on, a premature retirement can have detrimental effects on one’s finances

Preparing for Early Retirement as a Result of Being Fired

Due to unfortunate circumstances, you can also lose your job in your late 50s or early 60s and in the process, find it difficult to find another job on a full-time basis.

Indeed, such a scenario can have a detrimental impact on your Social Security benefits.

For starters, the Social Security Administration places the full retirement age around 66 or 67, depending on your place of birth.

So if you claim these benefits prior to this age (the earliest you can do so is around 62 years), you can experience a massive reduction in your Social Security benefits. Indeed, the reduction can be by a whopping 30%!

With this in mind, it is clear to see that claiming Social Security benefits early on as a result of retiring involuntary might hinder you from getting as much money as you had initially expected.

To prepare yourself for such an outcome, it is best to explore all the saving options that you have while you are still working, and highlight the one that could build your Social Security after you have retired.

Additionally, you can also open some of the most viable retirement accounts such as a Roth 401 (k) or an IRA.

Hence, in the event that you end up retiring at an earlier age, you might just be able to adjust your financial plans to maximize your savings during the years that you worked.

Clearing your debts early on can also prevent you from having a bad retirement

Complete Your Debts Early On

Another great strategy is to focus on debt elimination as much as you can at this given time.

The last thing that should be riddling you when your income drops significantly is being riddled by loans that you accrued as well as credit card debts.

Indeed, hiring the services of a financial adviser could give you the much-needed assistance to tackle any outstanding debts that you have.

Additionally, it is easier to tackle such a situation while you’re still working and have a steady income, instead of when you have retired and your income drops unexpectedly.

More in Finance & Business

-

`

Santo Spirits: Sammy Hagar and Guy Fieri’s Joint Venture

In the world of business partnerships, some combinations might seem unconventional at first glance. But when you delve deeper into the...

November 16, 2023 -

`

Everything You Need to Know About Mortgage Rate Lock

You have probably embarked on the exciting yet nerve-wracking voyage of purchasing a home. Amidst the sea of paperwork, open houses,...

November 9, 2023 -

`

7 Effective Ways to Make Your Business More Sustainable

In an age of rising environmental consciousness, making your business more sustainable isn’t just a trend; it’s a necessity. Sustainable practices...

November 3, 2023 -

`

Housing Market Going Up? Then Why Not Rent?

“Buy a house! It is the best investment!” How many times have you heard that? Probably enough to make a drinking...

October 29, 2023 -

`

Surprising! Celebs Who You Didn’t Know Had a Master’s Degree

When it comes to celebrities, we often associate them with glitz, glamour, and blockbuster movies. But did you know that some...

October 17, 2023 -

`

Navigating the Housing Maze: The 7% Mortgage Rate Quandary

If there is one thing that this year has thrown our way (apart from those fascinating tech gadgets we did not know...

October 12, 2023 -

`

Where to Buy a House in the U.S With a $100K Salary

Got a cool $100,000 annual paycheck in your pocket? Cheers to that accomplishment! With such a financial cushion, dreams of homeownership...

October 6, 2023 -

`

The “Grave” Housing Crisis Forcing U.S. Homeowners to Sell Their Houses

Every culture has its dreams and aspirations. For those living in the United States, it has traditionally been an idyllic house, spacious and...

October 1, 2023 -

`

Why Private Equity is Betting Big on Hollywood

Hollywood has long been a glamorous yet unpredictable industry. But what is new in Tinseltown? Private equity investments. Yes, that is right!...

September 19, 2023

You must be logged in to post a comment Login