JUST IN: Trump Opting for Dramatic Tax Simplifications

President Donald Trump reiterated the need for tax reform in the United States when he made his speech in North Dakota on Wednesday, September 6th. The President talked about his four goals for updating the U.S. tax system.

Joseph Sohm / Shutterstock

To begin with, the President expounded his perspective about the U.S. tax system. He described the tax code as a “self-inflicted economic wound.” He, then, promised to make things easier by reducing tax burdens on individuals and corporations. He hopes to improve the U.S. economy, generate jobs for Americans and restore America’s competitive edge by having these tax cuts and tax reform.

He mentioned that the United State Companies are obliged to “park trillions of dollars overseas” because of high corporate tax rates. He wants to lower taxes on businesses from 35 percent to 15 percent, as noted by CBS News.

He said that the business tax rate in America is the highest in the developed world. He further said that it is nothing more than a crushing tax on every product made in America. So, he hopes to lessen the tax rate on the U.S. business to keep the jobs across the nation.

“It is our time to invest in our country,” said President Trump. “We want to build beautiful new communities and rebuild the old ones, and we want to make America great again.”

The Key Goals

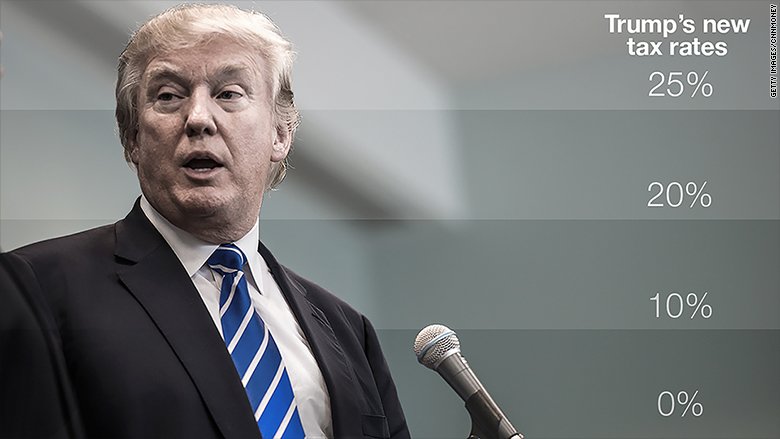

Secondly, is to reduce the taxes for middle-class families. He promised the biggest since the former President Ronald Reagan.

This goal could help Americans keep more of their hard-earned money. The reduced taxation for individuals could strengthen the U.S. economy by encouraging people to work harder, save more, and use their money for investments, according to Adam Michel, a policy analyst in the Thomas A. Roe Institute for Economic Policy Studies at the Heritage Foundation.

He further said that individual tax rates are really high. With this, lowering the tax rates could be very helpful for each individual and to the economy.

Lastly, the President wants tax relief for businesses. As mentioned above, he hopes to cut the corporate tax by 15 percent.

The Daily Signal reports that compared to China’s 25 percent or Ireland’s 12.5 percent, the United States offers one of the least attractive tax business environments in the world.

Michel said that America corporate tax rate is imposed on income earned in other countries. This encourages businesses to keep trillion of dollars overseas. He further said that the combination of the worldwide tax, enforced at internationally high rates, makes America business uncompetitive relative to the rest of the world.

He suggested that America-first tax reform would make America the most attractive place in the world to do business.

“Re-establishing the Economic Dominance”

The President would like to enforce this tax reform for the United States to “re-establish its economic dominance.” He implied that this tax reform will be “pro-growth, pro-worker, pro-jobs, pro-family, and pro-American.”

The president wishes to push tax reforms for his people and their welfare.

For those who want to vote against the tax reform, the President said, “Anyone who is going to vote against tax reform, you need to vote ‘em out of office because it’s so bad.”

Meanwhile, enforcing this tax overhauls could relief each individual and companies of the United States and will improve the nation’s economy making America great again as the President implied.

The President is committed to administering these tax overhaul goals. He said that he is willing to work with both parties namely the Democratic and the Republicans congressional leaders about his tax reform goals.

Certainly, once these tax reform goals were implemented, there would be great changes in the lives of each individual and company regarding their finances.

Trump on Hurricane Harvey Victims

Trump assures that the government puts the victims of any calamities in its priorities.

Meanwhile, the President was reminded of those affected by Hurricane Harvey and the approaching Hurricane Irma that will hit Florida in the coming days. He offered thoughts and prayers for them. He said that their hearts are heavy with sadness.

“Together we will recover and we will rebuild,” said Mr. Trump.

More in Legal Advice

-

`

Santo Spirits: Sammy Hagar and Guy Fieri’s Joint Venture

In the world of business partnerships, some combinations might seem unconventional at first glance. But when you delve deeper into the...

November 16, 2023 -

`

Everything You Need to Know About Mortgage Rate Lock

You have probably embarked on the exciting yet nerve-wracking voyage of purchasing a home. Amidst the sea of paperwork, open houses,...

November 9, 2023 -

`

7 Effective Ways to Make Your Business More Sustainable

In an age of rising environmental consciousness, making your business more sustainable isn’t just a trend; it’s a necessity. Sustainable practices...

November 3, 2023 -

`

Housing Market Going Up? Then Why Not Rent?

“Buy a house! It is the best investment!” How many times have you heard that? Probably enough to make a drinking...

October 29, 2023 -

`

Surprising! Celebs Who You Didn’t Know Had a Master’s Degree

When it comes to celebrities, we often associate them with glitz, glamour, and blockbuster movies. But did you know that some...

October 17, 2023 -

`

Navigating the Housing Maze: The 7% Mortgage Rate Quandary

If there is one thing that this year has thrown our way (apart from those fascinating tech gadgets we did not know...

October 12, 2023 -

`

Where to Buy a House in the U.S With a $100K Salary

Got a cool $100,000 annual paycheck in your pocket? Cheers to that accomplishment! With such a financial cushion, dreams of homeownership...

October 6, 2023 -

`

The “Grave” Housing Crisis Forcing U.S. Homeowners to Sell Their Houses

Every culture has its dreams and aspirations. For those living in the United States, it has traditionally been an idyllic house, spacious and...

October 1, 2023 -

`

Why Private Equity is Betting Big on Hollywood

Hollywood has long been a glamorous yet unpredictable industry. But what is new in Tinseltown? Private equity investments. Yes, that is right!...

September 19, 2023

You must be logged in to post a comment Login