Great Methods You Can Use for Financing Your Business

It can be difficult to find methods for financing your business in different economic climates. This is regardless of whether you are looking for start up funds, capital for an expansion or to tide over difficult times. Unfortunately, the present day circumstances have made it even more difficult to generate the funds needed for financing your business.

You definitely have the option of choosing any method you have in your mind but there is no reason why you shouldn’t consider some of the methods we have described. They are effective for raising the finances you need for the business. What are the methods you can use for financing your business?

A Bank Loan Will Prove Helpful For Financing Your Business

Lending standards have become stringent and most banks are reluctant to extend the finances demanded by business owners or new entrepreneurs. However, J.P. Morgan Chase and the Bank of America have set aside additional funds for business enterprises of the small variety. Therefore this is an option which you should be considered for financing your business.

Using Your Credit Card

Using your credit card for financing your business is another option which you can consider.Although, you are advised also to factor in the risks which can be serious. Fall behind on your payments and your credit scores will be taking a dive. Make minimum payments every month and you will soon be looking at a hole you cannot get out of. Using your credit card for financing your business is an option you should consider only when you find yourself in an extremely difficult position.

Using your credit card for financing your business is another option which you can consider.Although, you are advised also to factor in the risks which can be serious. Fall behind on your payments and your credit scores will be taking a dive. Make minimum payments every month and you will soon be looking at a hole you cannot get out of. Using your credit card for financing your business is an option you should consider only when you find yourself in an extremely difficult position.

Tap Into Your 401(k)

If you are considering starting a business when you are unemployed the funds lying in your 401(k) can help you by providing the finances you need for your business. The provisions in the tax code also make it possible for you to withdraw money from the 401(k) for financing your business without penalties. Only if you are careful enough to follow the right steps.

The steps are not difficult but you are advised to seek help from someone because you could be faced with legal complexities. You just need to remember you are using your retirement funds for financing your business. If things don’t work out as anticipated you stand to lose not just your business but also your retirement funds.

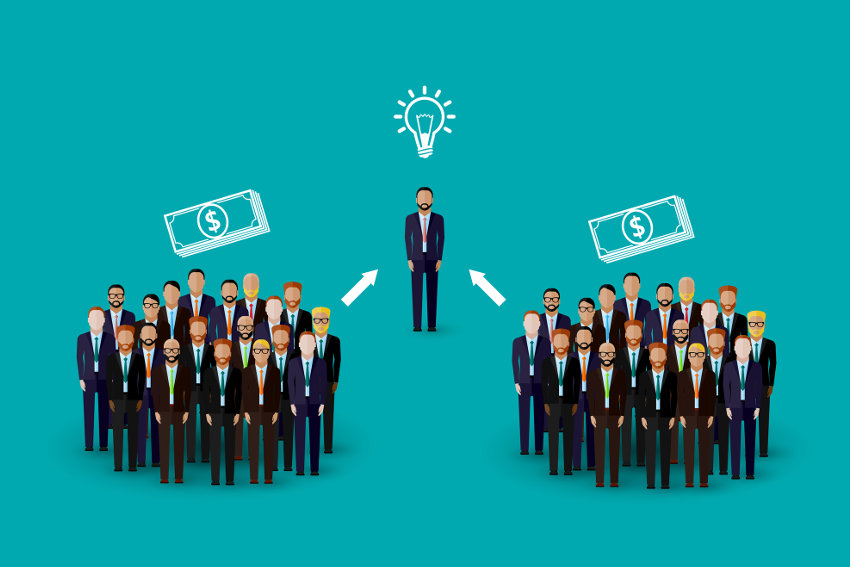

Crowdfunding

Crowdfunding sites like Indiegogo and Kickstarter.com can be an effective method to raise money for financing your business. You can set a goal for how much money you would like to raise over a period of 60 days. You also need to create a basic landing page for your idea or the product you intend to promote and provide information about the inspiration which prompted you to create the idea, create a video to give visitors to the site a view of your product.

Crowdfunding sites like Indiegogo and Kickstarter.com can be an effective method to raise money for financing your business. You can set a goal for how much money you would like to raise over a period of 60 days. You also need to create a basic landing page for your idea or the product you intend to promote and provide information about the inspiration which prompted you to create the idea, create a video to give visitors to the site a view of your product.

You should also have some pictures as well which can be viewed by people who are interested in backing you. Crowdfunding is becoming extremely popular because it is a reward based site. You can offer rewards to your backers but are not required to offer them a share of your business.

If your campaign generates more funds than budgeted you get all the money. On the other hand, you get nothing if your campaign does not generate or only generates a small percentage of the funds budgeted. This is a good option for financing your business and also to maintain total control over the business you are establishing.

A Partner Can Also Help In Financing Your Business

There are a number of people who are looking to establish a business but are unable to do so for a variety of reasons. If you can find an individual who is willing to be your partner you will have found an individual who can help in financing your business. However, you must understand you need to have a proper exit strategy and apply every rule which may be required without exceptions. Having a partner will also mean you are giving away a share of your business and therefore obtaining proper legal advice is something you cannot afford to ignore.

Try some of the strategies mentioned and you may find one of them helpful for financing your business.

More in Finance & Business

-

`

Santo Spirits: Sammy Hagar and Guy Fieri’s Joint Venture

In the world of business partnerships, some combinations might seem unconventional at first glance. But when you delve deeper into the...

November 16, 2023 -

`

Everything You Need to Know About Mortgage Rate Lock

You have probably embarked on the exciting yet nerve-wracking voyage of purchasing a home. Amidst the sea of paperwork, open houses,...

November 9, 2023 -

`

7 Effective Ways to Make Your Business More Sustainable

In an age of rising environmental consciousness, making your business more sustainable isn’t just a trend; it’s a necessity. Sustainable practices...

November 3, 2023 -

`

Housing Market Going Up? Then Why Not Rent?

“Buy a house! It is the best investment!” How many times have you heard that? Probably enough to make a drinking...

October 29, 2023 -

`

Surprising! Celebs Who You Didn’t Know Had a Master’s Degree

When it comes to celebrities, we often associate them with glitz, glamour, and blockbuster movies. But did you know that some...

October 17, 2023 -

`

Navigating the Housing Maze: The 7% Mortgage Rate Quandary

If there is one thing that this year has thrown our way (apart from those fascinating tech gadgets we did not know...

October 12, 2023 -

`

Where to Buy a House in the U.S With a $100K Salary

Got a cool $100,000 annual paycheck in your pocket? Cheers to that accomplishment! With such a financial cushion, dreams of homeownership...

October 6, 2023 -

`

The “Grave” Housing Crisis Forcing U.S. Homeowners to Sell Their Houses

Every culture has its dreams and aspirations. For those living in the United States, it has traditionally been an idyllic house, spacious and...

October 1, 2023 -

`

Why Private Equity is Betting Big on Hollywood

Hollywood has long been a glamorous yet unpredictable industry. But what is new in Tinseltown? Private equity investments. Yes, that is right!...

September 19, 2023

You must be logged in to post a comment Login