Want ‘Maximum’ Tax Refunds? Here Are Some Tips for You

With the tax season upon us, it is time to start thinking about how we can maximize our tax refunds. In order to maximize your refund, it is important to know what deductions and credits you are eligible for. While it may seem daunting, there are several steps that you can take to increase your chances of receiving the highest refund possible.

Keep in mind that tax refunds are not always surprises–instead, they are calculated vigorously. The more you become conscious of your finances, the maximum your tax refunds will be. In this article, we will go through some tips and tricks to help ensure that you get the maximum tax refund you are entitled to.

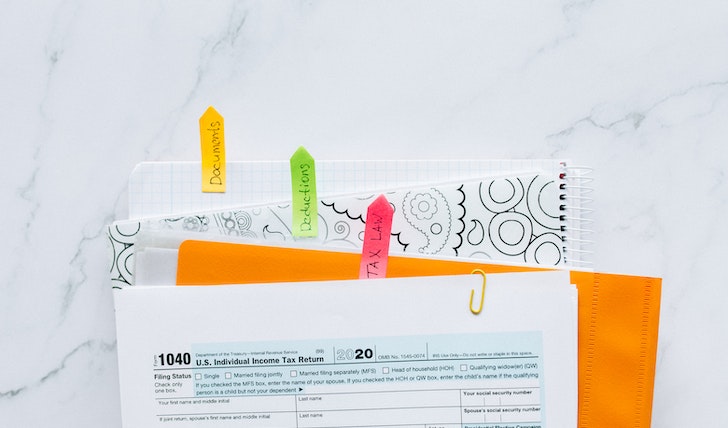

Nataliya / Pexels / It is always a great idea to look for ways of getting maximum tax refunds.

Have All Your Receipts Handy

Do not throw away those receipts! You will need them to claim any deductions for expenses related to work, education, medical, and charitable contributions. By keeping track of all the receipts, you can ensure you do not miss any legitimate claims during the filing process.

Look for All Available Deductions

The tax code is complex and can be overwhelming, but it is essential to know as much as you can about possible deductions and credits. These deductions, such as home office expenses or student loan interest, may seem small but they can add up quickly and result in significant savings on your tax return.

So, make sure to look for every single available deduction. No matter how small.

Antoni / Pexels / To claim possible deduction or credit, you will need to have all your financial documents handy.

Contribute More to Retirement Accounts

Retirement accounts grow tax-free. Thus, Contributing more to your retirement accounts could lower your tax liability and provide you with a higher refund.

Don’t Forget to Report Your Side Hustle

If you participate in any one-time gigs or have a side business, it is important to report that income to avoid penalties. Reporting that income can also provide you with additional deductions that could result in a higher refund.

Be Meticulous About the Details

Make sure all your claims are supported with proper documentation and details. After all, the devil is in the details. Filing a tax return with any mistakes, errors, or inadequate details could lead to a delay or, even worse, an audit.

Anete / Pexels / If you earn ‘extra’ money apart from your salary, report it to the relevant tax department.

Quick Sum Up & Recap

Income tax refunds are satisfying. But they do not come out of nowhere. Instead, you will have to work actively to get there. By keeping these tips in mind while preparing your tax return, you could increase your refund and reduce your tax liability.

Remember that it is always essential to seek the help of a qualified tax professional or software if you need advice on your tax deductions and credits. Gathering all the necessary information is the first step in your refund journey. If you have all these handy, you can ace your tax refunds – getting maximum refunds this year.

More in Finance & Business

-

`

Why You Need to Think Twice Before Buying a House

So, you have been scrolling through real estate listings, envisioning your dream kitchen, and even bookmarking paint colors for the nursery....

November 26, 2023 -

`

Santo Spirits: Sammy Hagar and Guy Fieri’s Joint Venture

In the world of business partnerships, some combinations might seem unconventional at first glance. But when you delve deeper into the...

November 16, 2023 -

`

Everything You Need to Know About Mortgage Rate Lock

You have probably embarked on the exciting yet nerve-wracking voyage of purchasing a home. Amidst the sea of paperwork, open houses,...

November 9, 2023 -

`

7 Effective Ways to Make Your Business More Sustainable

In an age of rising environmental consciousness, making your business more sustainable isn’t just a trend; it’s a necessity. Sustainable practices...

November 3, 2023 -

`

Housing Market Going Up? Then Why Not Rent?

“Buy a house! It is the best investment!” How many times have you heard that? Probably enough to make a drinking...

October 29, 2023 -

`

Surprising! Celebs Who You Didn’t Know Had a Master’s Degree

When it comes to celebrities, we often associate them with glitz, glamour, and blockbuster movies. But did you know that some...

October 17, 2023 -

`

Navigating the Housing Maze: The 7% Mortgage Rate Quandary

If there is one thing that this year has thrown our way (apart from those fascinating tech gadgets we did not know...

October 12, 2023 -

`

Where to Buy a House in the U.S With a $100K Salary

Got a cool $100,000 annual paycheck in your pocket? Cheers to that accomplishment! With such a financial cushion, dreams of homeownership...

October 6, 2023 -

`

The “Grave” Housing Crisis Forcing U.S. Homeowners to Sell Their Houses

Every culture has its dreams and aspirations. For those living in the United States, it has traditionally been an idyllic house, spacious and...

October 1, 2023

You must be logged in to post a comment Login