Wall Street Rollercoaster: From Sky-High Upgrades to the Downgrade Dilemma

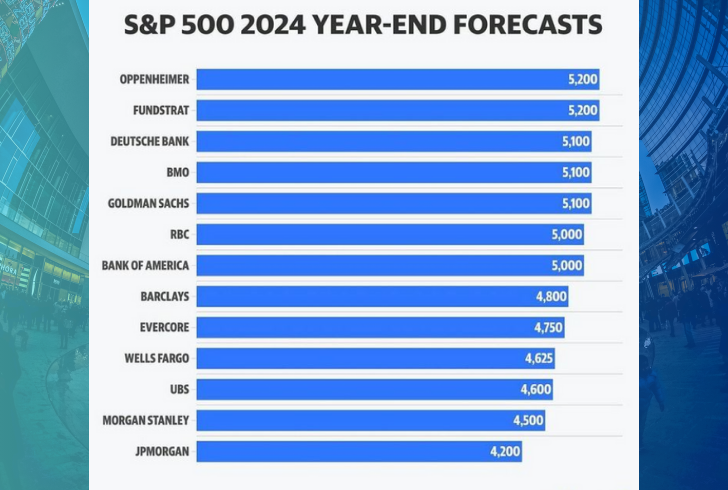

Wall Street, the epicenter of financial prowess, has been witnessing intriguing developments in its stock market. RBC Capital’s Lori Calvasina recently adjusted her 2024 price target for the S&P 500, sending ripples through the financial landscape.

The numbers tell a story of fluctuating expectations, but what lies beneath this numeric surface unveils a nuanced narrative of market sentiment, Federal Reserve maneuvers, and investor anticipation.

Calvasina’s Calculated Move: The Numbers Game

In a strategic move, Lori Calvasina raised the 2024 price target for the S&P 500 from 5,000 to 5,150. However, this seemingly bullish adjustment conceals a more tempered outlook compared to the one presented by her team just a few months ago in November 2023.

The initial target represented a 10% gain, but with the new projection, enthusiasm has waned, settling at an 8% gain from the index’s December 2023 close.

Instagram | garcapital | Lori Calvasina raised the 2024 price target for the S&P 500 from 5,000 to 5,150.

Reading Between the Lines: The “Higher but Lower” Outlook

The S&P 500’s Monday close at 4,764 forms the backdrop of RBC Capital’s “higher but lower” outlook. Calvasina’s perspective hinges on market sentiment, particularly the exuberance triggered by the Federal Reserve’s tone and forecasts in December.

The central bank’s predictions of a more aggressive interest rate decline in 2024 initiated a rally across asset classes, pushing the 10-year Treasury yield below 4% and propelling the Dow Jones Industrial Average to a record high.

A Rocky Start to 2024: The Hangover Effect

However, the optimism proved short-lived as stocks stumbled at the beginning of 2024, marking their worst start since 2016. One Wall Street strategist even likened the market’s early struggles to a “hangover” from the remarkable 2023, where the S&P 500 soared over 20% and the Nasdaq saw gains exceeding 40%.

Sentiment Shift: The American Association of Individual Investors’ Survey

RBC Capital points to the American Association of Individual Investors’ sentiment survey, a closely monitored indicator of market mood. The recent uptick in bullish sentiment suggests a flat market over the next three months, with gains estimated at around 6% over the next 12.

This is a noticeable shift from mid-November, when the same measure hinted at a more optimistic projection of a 10% rise over the next year.

Market’s Conundrum: Anticipating, Reacting, or Imposing?

Freepik | Lower interest rates traditionally favor stocks.

The swift oscillation in sentiment indicators brings us to a pivotal question that has loomed large for investors in recent months: Are markets trying to anticipate, react to, or impose a particular outcome on the Federal Reserve?

Lower interest rates traditionally favor stocks, and the prevailing logic suggests that the market’s upward trajectory is rooted in the anticipation of reduced interest rates in 2024. The December confirmation from the Fed merely reinforced investors’ belief that this strategic bet was indeed the right one.

Buy the Rumor, Sell the News: Unpacking December’s Pullback

The classic adage, “markets buy the rumor and sell the news,” provides a lens through which we can interpret the modest pullback observed since December’s highs. Once the Federal Reserve officially declared its intention to lower rates, the impetus for the trade diminished. This phenomenon underscores the dynamic nature of the market, where swift shifts in sentiment can impact trading strategies and outcomes.

Intriguing Insights, Uncertain Paths: What Lies Ahead

As we delve into the intricacies of Wall Street’s recent market dynamics, the landscape appears both fascinating and uncertain. The interplay between projections, sentiment shifts, and the Federal Reserve’s influence creates an ever-evolving narrative that demands careful navigation for investors.

Pixabay | davidvives90 | Wall Street’s journey from stock market upgrades to downgrades unfolds as a complex tale of market dynamics and investor sentiment.

Navigating the Uncertainty With Informed Decision-Making

Wall Street’s journey from stock market upgrades to downgrades unfolds as a complex tale of market dynamics and investor sentiment. Lori Calvasina’s adjusted price target reflects not only numerical adjustments but also the ebb and flow of confidence in the face of evolving economic indicators.

As investors chart their course in this ever-shifting terrain, staying informed and agile becomes paramount. The market, a living entity, responds to a myriad of factors, and successful navigation requires a nuanced understanding of the currents beneath the surface.

In this intricate dance between projections and realities, the key lies in adaptive strategies and a keen awareness of the broader financial landscape. As we traverse the uncertain waters of Wall Street’s stock market, one thing remains clear: informed decision-making, rooted in a deep understanding of market dynamics, will be the compass guiding investors through the twists and turns that define this intriguing financial journey.

More in Pocket Change

-

`

Santo Spirits: Sammy Hagar and Guy Fieri’s Joint Venture

In the world of business partnerships, some combinations might seem unconventional at first glance. But when you delve deeper into the...

November 16, 2023 -

`

Everything You Need to Know About Mortgage Rate Lock

You have probably embarked on the exciting yet nerve-wracking voyage of purchasing a home. Amidst the sea of paperwork, open houses,...

November 9, 2023 -

`

7 Effective Ways to Make Your Business More Sustainable

In an age of rising environmental consciousness, making your business more sustainable isn’t just a trend; it’s a necessity. Sustainable practices...

November 3, 2023 -

`

Housing Market Going Up? Then Why Not Rent?

“Buy a house! It is the best investment!” How many times have you heard that? Probably enough to make a drinking...

October 29, 2023 -

`

Surprising! Celebs Who You Didn’t Know Had a Master’s Degree

When it comes to celebrities, we often associate them with glitz, glamour, and blockbuster movies. But did you know that some...

October 17, 2023 -

`

Navigating the Housing Maze: The 7% Mortgage Rate Quandary

If there is one thing that this year has thrown our way (apart from those fascinating tech gadgets we did not know...

October 12, 2023 -

`

Where to Buy a House in the U.S With a $100K Salary

Got a cool $100,000 annual paycheck in your pocket? Cheers to that accomplishment! With such a financial cushion, dreams of homeownership...

October 6, 2023 -

`

The “Grave” Housing Crisis Forcing U.S. Homeowners to Sell Their Houses

Every culture has its dreams and aspirations. For those living in the United States, it has traditionally been an idyllic house, spacious and...

October 1, 2023 -

`

Why Private Equity is Betting Big on Hollywood

Hollywood has long been a glamorous yet unpredictable industry. But what is new in Tinseltown? Private equity investments. Yes, that is right!...

September 19, 2023

You must be logged in to post a comment Login